What is GST?

The Goods and Services Tax (GST) is hailed as the most important tax reform since independence. It is a comprehensive indirect tax that will subsume the existing central and state taxes. The GST aims to cut red tape for taxpayers by replacing an array of central excise and state levies such as sales tax and VAT which currently range from 25 per cent to 30 per cent by a single rate of about 18 per cent that is currently under consideration.

The services tax which currently works out to 14.5 per cent after including the Swachh cess will go up to 18 per cent to bring it at par with the goods tax so that there is a uniform tax for both goods and services in the new GST regime.

As per the studies of National Council of Applied Economic Research (NCAER), the preliminary results indicate that the growth in GDP can be between 2-2.5 % with the implementation of a well designed GST and the increase in exports can be between 10-14 %.

Current Taxation System: The Need for GST!

1) Complexity of Taxation Regime – Taxes in India are levied by the central government, state governments and the local bodies. Income tax, Excise duty, Service tax and Central Sales tax (CST), Securities Transaction tax is levied by the center.

VAT/sales tax, Entry tax, State excise, Property tax, Agriculture tax is charged by the State governments. Local bodies like municipalities charge octroi tax for entry into a particular area.

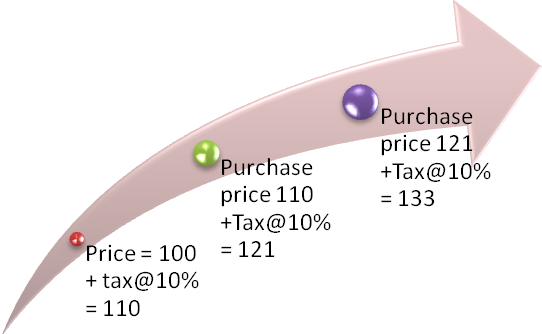

2) Cascading Effect – Also referred to as ‘taxation over taxes’. Cascading effect of taxes is one of the major distortions of the Indian taxation regime. Federal structure of our democracy, allows both states and center to levy taxes separately and this has caused cascading.

3) Value Added Tax (VAT) – is a destination based tax (similar to GST). It was first introduced in 2005 as an indirect tax. Despite its initial success in reducing the cascading effect it has many shortcomings which warrant for a full fledged GST.

(i) Input credit is available only on excise duty paid on raw materials under VAT. No input credit on other taxes and duties paid on post manufacturing activities.

(ii) Services are taxed selectively and only at the centre.

(iii) CENVAT allowed on goods remains included in the value of goods to be taxed.

(iv) Inter state tax is levied on inter state transfer of goods and there is no input credit for it.

(v) Sectors like real estate were exempt from VAT

4) Ease of Doing Business – The presence of multiple taxes along with the complications in various taxation procedures creates hardships for individuals and companies alike. Compliance and administrative procedures across state as well as between center and states create time and cost overruns. Once GST is introduced it will lead to simplification of procedures leading to a boost in economic growth.

Structure of Implementation of GST: How will it work?

More than 140 countries have already implemented GST. Majority of them are following the single GST model. While countries like Canada and Brazil follow the dual GST model.

1) India would be the following the dual GST model – Central GST (CGST) and State GST(SGST).

CGST – Excise Duty, Additional duties on Excise, service tax, surcharges and cesses

SGST – State VAT, Central Sales Tax, Luxury Tax, Entertainment Tax, State surcharges and cesses

Excluded Items – Taxes on Alcohol, GST will apply to five petroleum products at a later date

2) In case of interstate transactions, Integrated-GST (IGST) will be levied upto 1%. The Center would levy IGST.

3) The GST Council will recommend rates of tax, period of levy of additional tax, principles of supply, special provisions to certain states etc. The GST Council will consist of the Union Finance Minister, Union Minister of State for Revenue, and state Finance Ministers.

4) Parliament may, by law, provide compensation to states for any loss of revenue from the introduction of GST, up to a five year period.

Issues with GST: Why is it stuck?

1) The Inclusions and Exclusions – There has been a long contention between the Centre and the States about inclusion/exclusion of certain goods and taxes from the ambit of GST, with the States insisting on the exclusion of key sectors such as petroleum, tobacco, alcohol and real estate. There is the fear of loosing the fiscal autonomy and revenues from these sectors by the states.

It is well known that sectors such as real estate and alcohol are plagued by lack of transparency and are havens for tax evasion. For this reason, many international jurisdictions such as Australia, Canada, New Zealand and South Africa cover these sectors in their VAT/GST.

2) Revenue Neutral Rate (RNR) – The Report on Revenue Neutral Rate and Structure of Rates for the Goods and Services Tax (RNR Report) specifically mentions that there is a very strong association between ‘rate of tax’ and ‘level of compliance’. The report observes that a 1 percentage point increase in the standard rate worsens compliance by 1.22 percentage points.

A panel headed by Chief Economic Adviser Arvind Subramaniam proposed that the standard revenue-neutral GST rate could be in the range of 23-25%. This rate could be in the range of 18-19% if there is only a single GST rate, according to the institute’s calculations. However, if goods and services are taxed at different rates, the standard GST rate will be in the range of 23-25%.

3) The 1% Additional Levy – is being resented by manufacturers and traders alike. The objective of the levy of the additional GST at the rate of 1% is to compensate the States which have a developed manufacturing base such as Maharashtra, Karnataka etc. Such states consequently have a high CST collection. It is a common fear among these states that the states would lose the CST collection on the goods manufactured in such states causing revenue loss. Unlike destination based taxation regime in GST, this additional tax is envisaged to be an origin based tax wherein the proceeds would go to the State Government from where the supply originates.

But this levy would hinder the creation of a unified national market and defeat the purpose of GST. The opposition party has been demanding for the removal of this levy.

4) Compensation History – The issue about the compensation of states for five years to the extent of 100 per cent of the loss is another bottleneck. The Centre’s agreeing to the states’ demand for 100 per cent for five years has been a master-stroke. In fact, this will not be necessary for five years at all. In all arguments of the Centre as well as the expert committees on the subject, it has been held that the revenue will increase substantially, if only for better compliance and trade facilitation which will increase due to common market.

But since the rollout of the VAT, during which the central government dilly-dallied on loss compensation (arising out of lowering of CST rate), states have been wary of a repeat experience with GST. As a result, state FMs have insisted the centre include a provision in the Constitution to guarantee compensation towards losses, something that both the erstwhile UPA as well as the incumbent NDA government have been reluctant to do.

GST could be the much awaited improvement in our taxation regime. The question that is in front of us is that Do we want a comprehensive yet delayed version or the diluted and early one?