FDI flows into India nearly doubled in 2015: UNCTAD

According to the annual report of the United Nations Conference on Trade and Development, Global FDI flows “unexpectedly†increased significantly by 36 per cent to $1.7 trillion and this is closer to the pre-crisis level and the highest since the global financial and economic crisis. Developing economies, as a whole, saw their FDI reaching a new high of $741 billion – 5 per cent higher than 2014.

Analysis

Annual report on FDI flows globally and specially into India now gone up by 36%, since last year and despite the decline in the global economy, this is positive news for India. The prospects of creating employment and income in the economy of India are something to cheer about.

The government has been able to create a positive sentiment in the global arena through its policy announcements such as the recent Start Up in terms of tax released and the resources that will be made available to entrepreneurs and also the policy decisions taken in the past and their implementations such as various FDI programmes launched by Prime Minister.

A very interesting juncture in the UNCTAD reports states about $1.7 trillion of increase in FDI worldwide. Though there was decline in FDI of various nations, for India it was almost nearly doubled in 2015 to USD 59 billion while the US emerged as the top host country for FDI last year.

Distribution of FDI for the year -Â The FDI inflow of $59bn for the year has went up by 36% and the inflow has been coming from US, UK, Netherlands and couple of countries which are the prime contributors. The high amount of infusion has been seen in the Greenfield projects and other sector include the ICT and power generation for transportation so as to have infrastructure into India, which includes the Electronics, communication, power generation, roads, railways, highways. Infrastructure is the sector which is actually getting chunk of FDI. Â These are the sectors that are directly linked to the poorest in the country. All three key sectors of growth i.e. services, agriculture and industry have been benefited from this.

Brownfield FDI vs Greenfield FDI -Â Green-field investments occur when a parent company begins a new venture by constructing new facilities in a country outside of where the company is headquartered. There are several reasons why a company opts to build its own new facility rather than purchase or lease an existing one. The primary reason is that a new facility offers the maximum design flexibility and efficiency to meet the project’s needs. An existing facility forces the company to adjust based on the present design.

Brown-field investments occur when a company or government purchases an existing facility to begin new production. The clear advantage of a brown-field investment strategy is that the building is already constructed. The costs of starting up may be greatly reduced. The time devoted to construction can be avoided as well.

Investment Fueled Growth - The IIP data published recently does not indicate a translation of the investment into growth. The indicators for manufacturing factory data of procurement does not really spike as quickly as it dropped. But if we look at the retail segment and the domestic consumption, both have seen a rise in the last six months. There has not been a similar rise in the private investment by corporate owing to strained balance sheets.

Source: TheHindu

More Plastic than Fish in the Ocean: WEF

In a report by the World Economic Forum (WEF) it estimates that every year at least 8 million tonnes of plastics leak into the ocean, which is equivalent to dumping the contents of one garbage truck into the ocean every minute and oceans will have more plastics than fish by 2050 if the ongoing practice of dumping plastics continues.

It reveals that 95% of the value of plastic packaging material, worth $80 billion-$120 billion annually, is lost to the economy.

Analysis

Global production of plastics is increasing every year and the amount of plastic litter that is finding its way into the environment and into the oceans is also increasing, especially in the areas of the world where waste management practices are not keeping up with this rapid increase. From the whale, sea lions, and birds to the microscopic organisms called zooplankton, plastic has been, and is, greatly affecting marine life on shore and off shore.

Environmentalists have long denounced plastic as a long-lasting pollutant that does not fully break down, in other terms, not biodegradable.

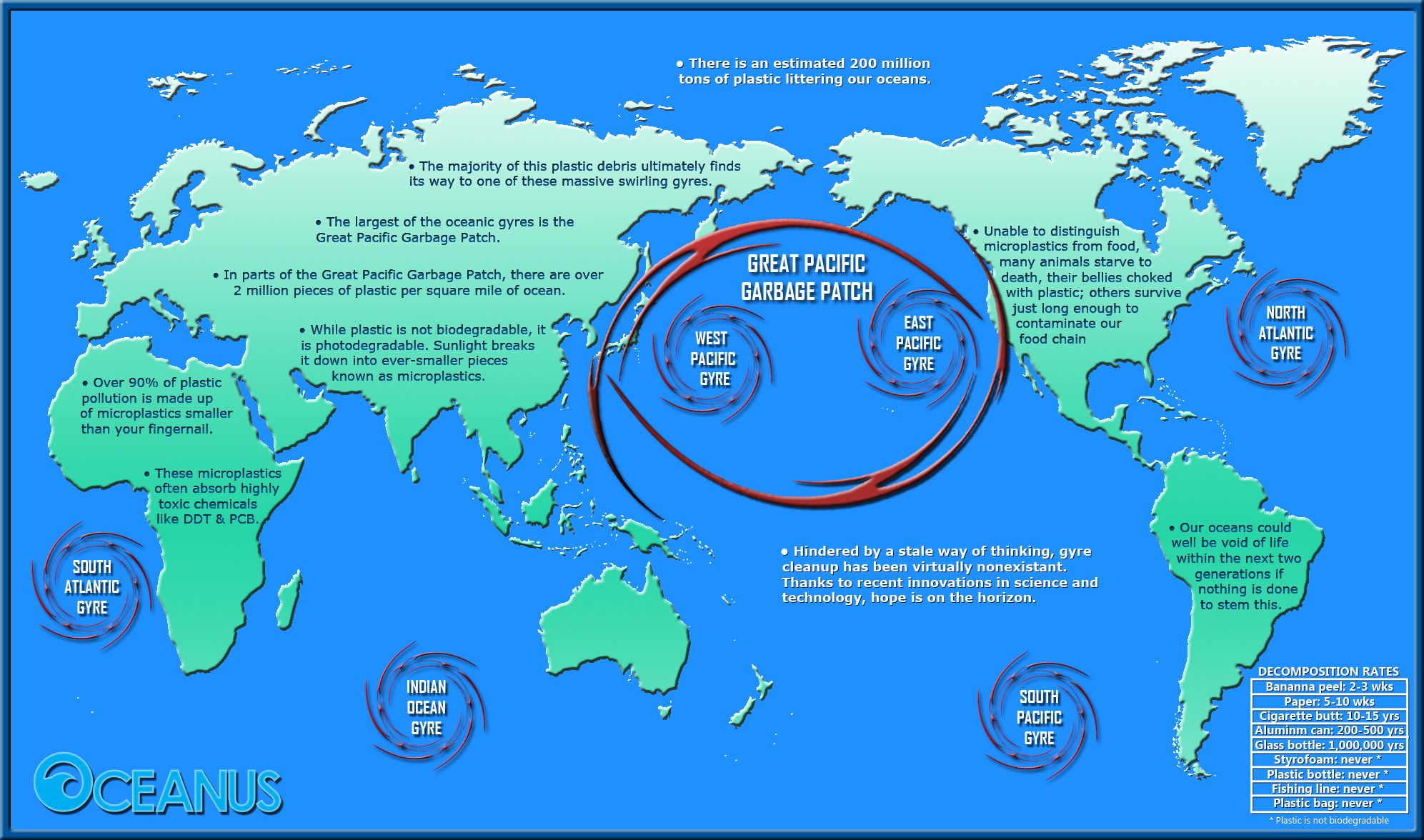

However, most of the littered plastic waste worldwide ultimately ends up at sea. Swirled by currents, plastic litter accumulates over time at the center of major ocean vortices forming “garbage patchesâ€, i.e. larges masses of ever-accumulating floating debris fields across the seas. The most well known of these “garbage patches†is the Great North Pacific Garbage Patch, discovered and brought to media and public attention in 1997 by Captain Charles Moore. Yet some others large garbage patches are highly expected to be discovered elsewhere, as we’ll see further.

The WEF report has suggested steps to have an effective after-use pathways for plastics, drastically reducing leakage of plastics into natural systems, especially oceans, and finding alternatives to crude oil and natural gas as the raw material of plastic production.

Capital Subsidy for Textiles

The government had announced 15 per cent capital subsidy for investments in technical textiles under the Amended Technology Upgradation Fund Scheme. The Centre of Excellence for Industrial Textiles/Home Textiles at PSG College of Technology would have plug-and-play facilities (focus incubation centre) for potential entrepreneurs in technical textiles.

The Ministry is streamlining issues at Sardar Vallabhbhai Patel International School of Textiles and Management here and has worked out a plan to strengthen the institute. It has formed a panel of guest lecturers so that students are not affected, according to Textile Commissioner Kavita Gupta.

Technical textiles industry is projected to grow at 20 per cent year-on-year and the segment’s potential is largely untapped in the country.  From domestic growth to export to import substitution, the segment had huge potential in the country.

Analysis: Textile Industry in India

Textile is one of India’s oldest industries and has a formidable presence in the national economy inasmuch as it contributes to about 14 per cent of manufacturing value-addition, accounts for around one-third of our gross export earnings and provides gainful employment to millions of people. They include cotton and jute growers, artisans and weavers who are engaged in the organised as well as decentralised and household sectors spread across the entire country.

It enjoys possibly the widest linkages, both forward and backward, and contributes directly not only to the livelihood but also to the empowerment of largely the weaker sections of the society living in rural and semi-urban areas.

The industry suffers from issues like obsolete technology, low labour productivity, erratic power supply and stiff competition from the south east Asian economies.

Source – PIB, TheHindu